Govt Clears Air on Hustler Fund Disbursement to Minors and Unborn Children

The Ministry of Cooperatives has dismissed allegations that the Hustler Fund, officially known as the Financial Inclusion Fund, was given to unborn children and minors.

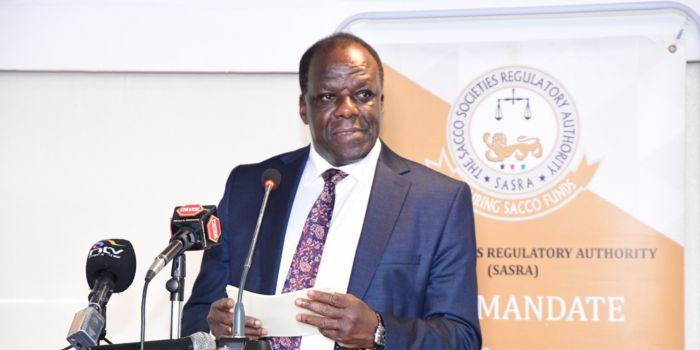

Speaking before the National Assembly Departmental Committee on Trade on Thursday, March 6, Cooperatives Principal Secretary (PS) Susan Mang’eni denied the claims.

She explained that the confusion arose due to errors in data extraction and not because of actual misallocation of funds.

Mang’eni clarified that the ministry has since corrected the records, ensuring that all individuals sampled have valid identity cards and active phone numbers.

“The data used in the audit report contained major extraction errors because the audit was not carried out in a live environment,” Mang’eni explained. She reassured the committee, saying, “We have since rectified the records, and every person sampled has a verified ID and a working phone number.”

She further emphasized that the Hustler Fund’s system is designed in a way that prevents minors from accessing loans. According to her, the government is committed to maintaining transparency and accountability in the management of the fund.

The PS also reiterated that the Hustler Fund is a key initiative aimed at supporting small businesses and individual entrepreneurs.

“The Hustler Fund plays a crucial role in promoting financial inclusion and empowering the economy. We have put in place strict measures to ensure that the money reaches the right beneficiaries,” she stated.

This clarification comes after a report by Auditor General Nancy Gathungu, which revealed that Ksh31.8 million was disbursed to 44,167 individuals classified as either minors or unborn children with birth dates set in the future.

According to the Auditor General’s findings, 1,186 children aged between 10 days and 17 years received a total of Ksh681,395 from the Hustler Fund. Additionally, 42,981 individuals with future birth dates were disbursed a total of Ksh31,135,690.

“A review of the customer database and opted-in records showed that some loan recipients were below the legal borrowing age of 18 years, while others had birth dates set in the future, beyond June 30, 2024,” Gathungu reported.

She warned that such discrepancies could make loan agreements with minors legally unenforceable, increasing the chances of loan defaults.

The government’s response aims to clear the air on the matter, assuring the public that the necessary steps have been taken to clean up the system and ensure the funds only benefit eligible citizens.

Join Gen z and millennials TaskForce official 2025 WhatsApp Channel To Stay Updated On time the ongoing situation https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30