Crypto Loan Repayment Terms: What You Need to Know

Why People Borrow Against Crypto: Use Cases and Examples

Introduction

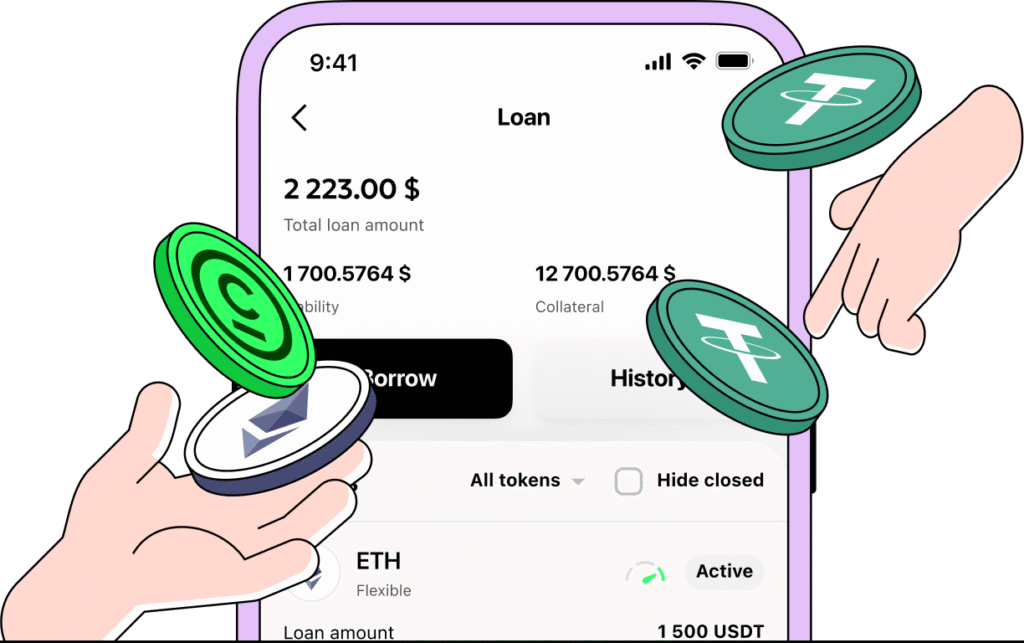

As cryptocurrency becomes more popular, many people are now using it not just to invest, but also as a way to get loans. These are called crypto loans, and they are growing fast. Instead of selling your crypto to get money, you can use it as collateral — meaning you lock it up, and borrow cash or stablecoins against it.

In this article, we will explain:

- Why people borrow against crypto

- Real-life examples and use cases

- How repayment works

- Important terms you should understand

This simple guide will help you know if a crypto loan is right for you — especially if you want to make smart financial decisions.

Why People Borrow Against Crypto

1. Avoid Selling Their Crypto Assets

Many crypto holders believe that the price of Bitcoin, Ethereum, or other tokens will rise in the future. Instead of selling, they use their crypto as collateral to borrow money. This way, they keep ownership of their coins while still accessing funds.

Example:

John owns 1 BTC, which is worth $70,000. He believes the price will increase. Instead of selling it to pay for home repairs, he takes a loan of $35,000 using his BTC as collateral.

2. Quick Access to Cash or Stablecoins

Crypto loans are faster than traditional bank loans. No long paperwork or credit checks. Platforms like Nexo, Aave, or Binance offer instant loans with just a few clicks.

Example:

Sarah needs $5,000 to pay for emergency medical bills. She doesn’t want to apply for a bank loan. She deposits $10,000 worth of ETH and borrows $5,000 in USDT within minutes.

3. Use for Business or Investment Opportunities

Some people borrow against their crypto to invest in other opportunities, like starting a small business or buying more crypto when prices are low.

Example:

Tom sees a great investment in a new startup. Instead of liquidating his crypto, he uses it as collateral and gets the funds to invest.

4. Tax Benefits in Some Countries

Selling crypto may lead to capital gains taxes. But borrowing doesn’t count as income in many places. So, people use loans to avoid immediate tax liabilities.

✅ Important Note: Always check your country’s tax rules before making a decision.

How Crypto Loan Repayment Works

When you take a crypto loan, you agree to pay back the amount borrowed, usually with interest. Here’s how it usually works:

- Collateral: You lock your crypto in the lending platform

- Loan Amount: You receive up to 50%–70% of the collateral value

- Interest Rate: Varies by platform; can be 4%–13% per year

- Repayment Period: Some platforms offer flexible, monthly, or fixed-term loans

- Repayment Options: You can repay in crypto, stablecoins, or fiat

Common Repayment Terms You Should Know

| Term | Meaning |

|---|---|

| LTV (Loan-to-Value) | The ratio of your loan amount to the value of your collateral. E.g., if you borrow $5,000 against $10,000 in crypto, your LTV is 50%. |

| Margin Call | If the value of your collateral drops, you may need to add more crypto to avoid liquidation. |

| Liquidation | If you don’t meet the margin call, the platform may sell your crypto to cover the loan. |

| APR (Annual Percentage Rate) | The total yearly cost of the loan, including interest and fees. |

Risks to Consider

- Market Volatility: Crypto prices can drop fast. You may lose your assets if you can’t top up your collateral.

- Platform Risks: Choose a trusted and secure lending platform to avoid scams or hacks.

- No Access to Locked Crypto: While your assets are collateral, you can’t trade or move them until you repay the loan.

Final Thoughts

Borrowing against your crypto can be a smart move — especially when you don’t want to sell your coins but need quick cash. Whether it’s for business, emergencies, or investment, crypto loans offer flexibility and fast access to money.

However, make sure you understand the terms well. Always borrow within your limit and keep an eye on the market. If used wisely, crypto loans can help you grow financially without losing your valuable digital assets.

Join Gen Z New WhatsApp Channel To Stay Updated On time https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30