When it comes to trading cryptocurrency, there are two main types of platforms you can use: centralized exchanges (CEXs) and decentralized exchanges (DEXs). Each of these has its own benefits and drawbacks. Knowing how they work and what makes them different can help you choose the right one for your goals and comfort level.

What Does Decentralized Mean in Cryptocurrency?

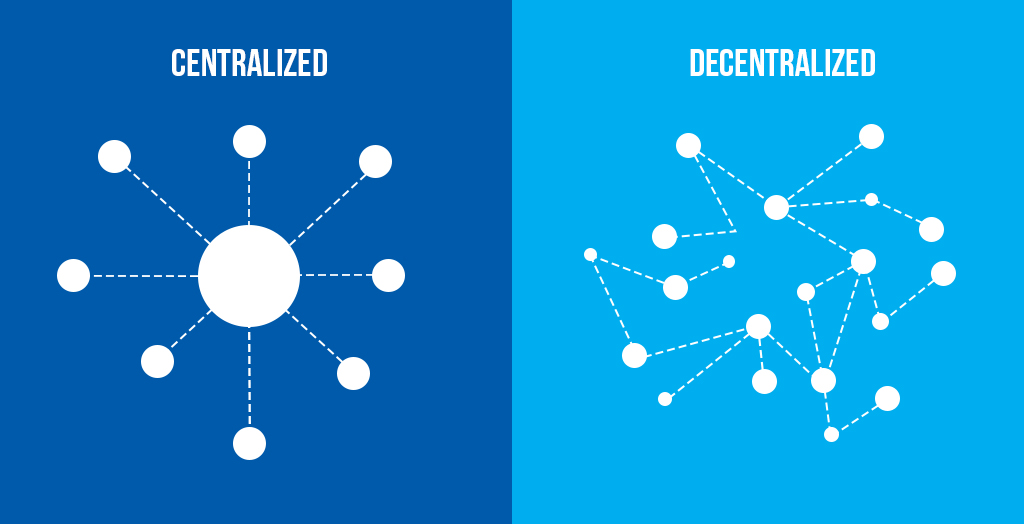

Decentralization is one of the key ideas behind cryptocurrencies. A decentralized crypto exchange doesn’t have a single company or person in charge. Instead of having a central authority managing everything, the platform runs on blockchain technology, allowing users to make trades directly with each other.

On a decentralized exchange, transactions happen peer-to-peer using smart contracts—automated programs that execute trades without needing someone to approve them. This setup gives users more privacy and complete control over their assets. You never hand over your funds to a third party, which means you always hold ownership of your cryptocurrency.

Another benefit of DEXs is that you usually don’t have to go through a sign-up process or share your personal details. This fits well with the crypto community’s focus on privacy and user empowerment.

What Is Centralized in Crypto?

A centralized crypto exchange is the opposite of a DEX. It’s run by a company that acts as a middleman between buyers and sellers. These platforms are very popular because they are easy to use, offer customer service, and provide extra features like the ability to trade with fiat money (like dollars or euros) and access to advanced trading tools.

However, when you use a centralized exchange, you give up control of your private keys. That means the platform holds your funds on your behalf, similar to how a bank holds your money.

This can be convenient, especially for beginners, but it also comes with risks—such as hacks, fraud, or the company shutting down.

Still, many people prefer centralized exchanges because of their speed, liquidity (ease of buying/selling), and professional interfaces.

Key Differences Between Centralized and Decentralized Crypto Exchanges

The biggest difference between a CEX and a DEX lies in who controls the money and how trades are carried out. On a centralized exchange, your crypto is stored by the platform, and trades are matched using a system called an order book, which pairs buyers and sellers.

In contrast, decentralized exchanges use smart contracts that allow people to trade directly with one another, without needing to trust a central platform. You remain in control of your crypto the entire time.

Centralized exchanges are generally faster and have higher liquidity because they operate in a more controlled environment. Decentralized platforms, while sometimes slower—especially when blockchain networks are busy—offer better privacy, transparency, and resistance to hacking.

What Is a Decentralized Crypto Exchange?

A decentralized crypto exchange (DEX) is a type of trading platform that lets people buy and sell crypto directly without using a middleman.

Examples include Uniswap, PancakeSwap, and dYdX. These platforms use smart contracts to automatically handle trades between users.

With a DEX, your crypto stays in your personal wallet until a trade is made. There’s no central company managing your assets, which means you’re in full control at all times.

This makes decentralized exchanges more in line with the original vision of cryptocurrency: to give people financial freedom, privacy, and full control over their money.

You can also explore our expert-reviewed list of the best DeFi exchanges if you’re interested in trying one out.

Pros and Cons of Decentralized Crypto Exchanges

Here’s a simple breakdown of the benefits and challenges of using DEXs:

Pros:

- You always keep control of your private keys and funds.

- No personal information is required—great for privacy.

- Access to a broad range of tokens and new DeFi projects.

Cons:

- Lower liquidity and slower trades compared to centralized platforms.

- Can be hard to use for beginners or non-technical users.

- No customer support if something goes wrong, since there’s no central operator.

Popular Decentralized Exchanges (DEXs) to Know About

Here’s a list of well-known DEXs, each offering unique features:

- Balancer: An automated portfolio manager and liquidity platform that supports multi-token pools and lets users create custom liquidity strategies.

- Curve: Known for low-fee stablecoin trading, Curve helps reduce impermanent loss and is ideal for those focused on stablecoin assets.

- DeFiLlama: A DEX aggregator that compares prices across multiple platforms to help users find the best trading rates.

- dYdX: A decentralized platform offering margin trading, lending, and derivatives—designed for advanced and professional traders.

- IDEX: A hybrid exchange that mixes the speed of centralized platforms with the self-custody of decentralized trading.

- Nomiswap: Offers low trading fees (0.1%) and cashback rewards, merging DeFi tools with a familiar trading experience.

- Osmosis: Built on the Cosmos blockchain, Osmosis supports cross-chain trading and offers an intuitive user interface.

- PancakeSwap: Operating on the Binance Smart Chain, it’s known for low costs, fast transactions, and high returns on yield farming.

- StackSwap: A Bitcoin-based DEX that introduces DeFi to the Bitcoin network, featuring AI-enhanced performance and low fees.

- SushiSwap: With over 400 listed tokens, SushiSwap offers fast swaps, staking options, and yield farming, all without requiring KYC.

- Uniswap: The largest DEX on Ethereum. It has deep liquidity, supports ERC-20 tokens, and offers a simple, user-friendly interface for all traders.

Join Gen Z New WhatsApp Channel To Stay Updated On time https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30