The Kenya Revenue Authority (KRA) has assured taxpayers that it is working on ways to ease financial pressure rather than increasing deductions from salaries.

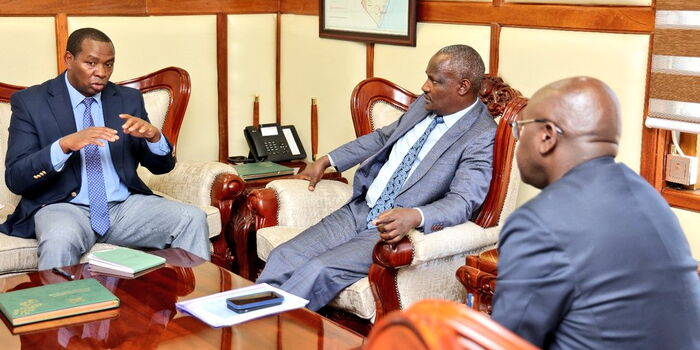

KRA Chairman Ndiritu Muriithi stated that the agency is focused on expanding the tax base to reduce the burden on workers.

Speaking in an interview with NTV on March 11, Muriithi emphasized that KRA will not impose additional taxes on salaries but will instead seek alternative ways to generate revenue.

“We will not increase deductions from pay slips any further. Our focus should be on reducing financial strain on salaries by broadening the tax base,” Muriithi explained.

Expanding the Tax Base Through Technology

To achieve this, KRA is leveraging technology to make tax compliance easier for individuals and businesses. Muriithi highlighted that one of the key areas of focus is improving Value Added Tax (VAT) collection.

He revealed that the tax agency has already put measures in place to track businesses that should be paying VAT but are not yet compliant. By adjusting VAT thresholds and streamlining the registration process, KRA aims to bring more businesses into formal taxation.

“We have reorganized our internal structure to create a dedicated department that will assist with tax registration, making it simpler for businesses to comply,” Muriithi stated.

Strengthening Compliance for PAYE

Muriithi also addressed concerns about Pay As You Earn (PAYE), clarifying that it is the responsibility of every employed individual to ensure tax compliance. However, he noted that employers act as collection agents on behalf of KRA.

“PAYE is a personal obligation, but the employer plays a key role in deducting and submitting the tax to KRA,” he said.

Improving eTIMS for Better Efficiency

Additionally, KRA is working on making its electronic Tax Invoice Management System (eTIMS) more user-friendly. The agency recognizes that some businesses have faced challenges using the system and is committed to simplifying it for better efficiency.

“Our tax system should not be complicated. We are improving eTIMS to make it more responsive and easier to use for taxpayers,” Muriithi assured.

These reforms are part of KRA’s broader strategy to enhance tax compliance without placing excessive financial pressure on individuals.

By focusing on expanding the tax base and improving technology, the agency aims to create a fairer and more efficient taxation system in Kenya.

Join Gen z and millennials TaskForce official 2025 WhatsApp Channel To Stay Updated On time the ongoing situation https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30