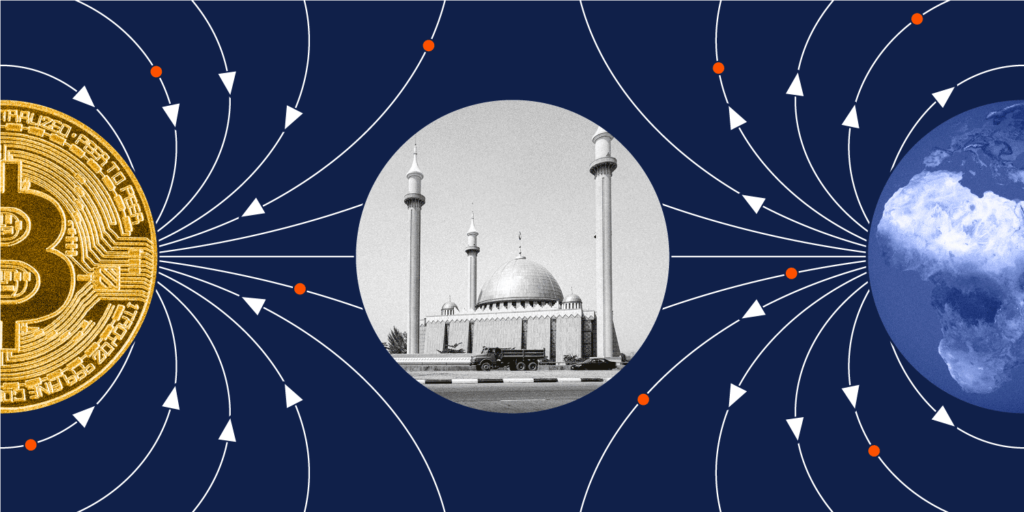

Crypto-based lending, particularly micro-loans, is emerging as a powerful alternative to traditional finance in Africa.

This sector is offering new financial opportunities to those excluded from conventional banking systems while also attracting users with its quick loan approvals and promising returns.

But how is crypto lending shaping up in Africa? Who is benefiting from it, and how are banks and regulators reacting to this rapidly evolving industry that is not free from risks such as fraud and scams?

A Shift in Financial Access

At first glance, the rise of crypto lending appears to be another instance of technology-driven financial inclusion. New-age startups are leveraging innovative solutions to bridge the gaps left by traditional banking systems, which often struggle under the weight of bureaucratic processes.

According to Nathan Lynch, a financial crime expert for Thomson Reuters in the Asia-Pacific and Emerging Markets and the author of The Lucky Laundry, African markets have consistently demonstrated an ability to use simple yet effective technology to address financial challenges.

“We have seen this before with mobile money solutions like M-Pesa and the use of SMS technology. Africa has a track record of adopting financial technology to solve real-world problems,” he said. Crypto lending represents the latest development in this ongoing transformation.

New Liquidity Pools Are Opening Doors for Lenders and Borrowers

In recent years, the pool of available funds for crypto loans has expanded significantly. This growth is fueled by inflationary pressures, economic uncertainties, and the declining value of many African currencies. More people are turning to cryptocurrencies as a safeguard against devaluation.

Topsy Kola-Oyeneyin, a partner at McKinsey’s Payments Practice in Nairobi, explained how this trend is influencing financial behavior:

“People are increasingly using crypto as a store of value, particularly stablecoins that can be converted into local currencies when needed. This strategy acts as a hedge against currency devaluation,” she said.

Beyond that, crypto holders can use decentralized finance (DeFi) platforms to lend out their digital assets and earn interest. This means that rather than merely holding cryptocurrency, individuals can now make their assets work for them, increasing their overall value.

On the borrowing side, individuals and businesses can use their crypto holdings as collateral to secure loans. The process is typically much faster than traditional bank loans, making it a preferred option for many.

However, there is still a significant barrier: a lack of awareness and understanding of how the crypto market works. Many underbanked individuals are unfamiliar with how to participate in crypto lending, which limits its reach.

Regulatory Challenges

Despite its potential, crypto lending faces stiff regulatory challenges in many African nations. A report from the US Library of Congress in November 2021 found that 23 out of 51 countries worldwide that have banned or restricted cryptocurrency use were in Africa.

Some countries, including Tunisia, Egypt, Morocco, and Algeria, have imposed total bans on crypto, while others—such as Nigeria, Lesotho, Togo, Burundi, Mali, and Senegal—have put strict regulations in place.

Nigeria, for example, has a significant unbanked population, yet the country’s central bank banned financial institutions from engaging with cryptocurrency in February 2021.

However, this move was followed by the launch of the eNaira, Nigeria’s central bank digital currency (CBDC), which aims to boost financial inclusion. Some experts speculate that CBDCs could introduce their own lending options in the future.

Collateral and Risk Factors

Wiehann Olivier, an audit partner and digital asset lead at Mazars in South Africa, acknowledged that while crypto lending has enormous potential, the requirement for collateral presents a challenge for financial inclusion.

“DeFi lending can offer significant interest rewards to lenders and attract new borrowers, but almost all crypto loans require collateral in the form of digital assets. This creates a risk because of the volatility in crypto markets,” he noted.

Borrowers must ensure their collateral value does not fall below a certain threshold—often between 50% and 80% of the loan amount—because smart contracts will automatically transfer the pledged assets to lenders if the value drops too much.

Most loans also come with high-interest rates, typically between 10% and 12%, making them attractive for lenders but potentially risky for borrowers who lack market knowledge.

Those unfamiliar with crypto price fluctuations may find themselves defaulting on loans, turning what seemed like a financial opportunity into a major setback.

Different Forms of Crypto Lending

Crypto lending comes in various forms. A SourceForge report lists 191 firms offering such services, from major trading platforms like Binance and Crypto.com to specialized DeFi lenders like AAVE and NFTfi.

NFTfi, for instance, allows users to put up non-fungible tokens (NFTs) as collateral for loans in cryptocurrencies like Wrapped Ethereum (WETH) and DAI. “The NFT is held in escrow until the borrower repays the loan,” explained Ani Alexander, NFTfi’s Chief Marketing Officer.

If a borrower defaults, the NFT is transferred to the lender without any central authority involvement.

Meanwhile, smaller African-focused crypto lending platforms such as KamPay and Koinwa are gaining traction, even though they don’t appear on major international listings.

No-Collateral Crypto Loans for Farmers

KamPay, a crypto-focused financial platform, is taking a different approach. The company is using cryptocurrency revenue from its services, including national lotteries in countries like Chad and Guinea, to fund micro-loans for African farmers.

Instead of receiving cash, farmers are given vouchers redeemable for agricultural supplies at Africa Grain and Seed (AGS) outlets.

The loan is repaid once the crops are harvested and sold, with payments processed through the KamPay wallet. “We don’t require collateral, but AGS helps us determine which farmers qualify for loans,” said Yigal Weinberger, KamPay’s Chief Technology Officer.

Fighting Fraud in Crypto Lending

One major concern in crypto lending is the risk of fraud. The Central Bank of Nigeria cited fraud prevention as one of its main reasons for launching the eNaira.

Nathan Lynch from Thomson Reuters highlighted that many crypto platforms lack proper Know-Your-Customer (KYC) and Anti-Money Laundering (AML) measures.

“The digital nature of these transactions means that people are rarely meeting in person, which increases the risk of identity fraud and money laundering,” he said.

For investors, he advised focusing on the “return of money” rather than just the “return on investment.”

South Africa’s Role in Crypto Regulation

South Africa is one of the largest crypto markets in Africa, but it has also experienced several major scams, including the Mirror Trading International (MTI) scandal, in which thousands of people lost Bitcoin before the company collapsed in 2020.

Despite the setbacks, South Africa remains largely unregulated, though the South African Reserve Bank (SARB) has announced that new regulations are expected soon.

“People are still skeptical due to past scams, but regulation is coming. We don’t know exactly what form it will take, but it’s a step in the right direction,” said Olivier.

SARB has stated that it aims to balance innovation with risk mitigation, ensuring that digital finance grows within a regulated framework. Experts believe South Africa’s regulatory approach will influence policies across the continent.

“Scams and fraud are pushing African governments to regulate crypto. The industry is here to stay—it’s just a matter of how it will be managed,” said Lynch.

As crypto lending continues to evolve, its future in Africa will largely depend on how well regulations can balance financial inclusion, innovation, and consumer protection.

Join Gen z and millennials TaskForce official 2025 WhatsApp Channel To Stay Updated On time the ongoing situation https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30