Traditional loan approval methods are often slow, paperwork-heavy, and involve manual verification. But with the rise of artificial intelligence (AI), financial institutions can now offer quicker, smarter, and more efficient lending through AI-based loan approval apps.

These advanced apps use machine learning to evaluate creditworthiness, detect fraud, and provide instant, personalized loan offers. This not only enhances the borrowing experience but also helps lenders lower risk and cut operational costs.

This comprehensive guide walks you through everything you need to know—from benefits and features to development steps and cost estimates—to build a powerful AI-driven loan approval application.

Global Market Insights: The Growth of AI in Lending

The global market for AI in lending is booming. It’s projected to reach $58.1 billion by 2033, up from $7.0 billion in 2023, growing at a CAGR of 23.5% from 2024 to 2033.

This explosive growth is driven by AI’s ability to:

- Speed up loan approvals,

- Improve risk analysis,

- Reduce fraud,

- And enhance user experience.

Financial institutions are rapidly integrating AI tools to make lending faster, smarter, and more accessible to wider audiences.

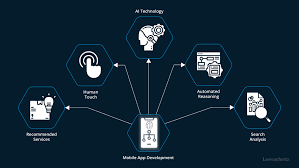

How AI Is Transforming Loan Approvals

AI improves the loan approval process by automating various stages and making decisions more precise. Here’s how AI revolutionizes lending in 8 powerful ways:

1. Automated Data Gathering and Analysis

AI pulls information from sources like credit reports, bank statements, and financial apps. Technologies like Natural Language Processing (NLP) and Optical Character Recognition (OCR) read and understand unstructured data, saving time and improving accuracy.

2. Advanced Credit Scoring

Unlike traditional models that rely mostly on credit scores, AI also considers alternative data like income trends, spending habits, job stability, and even education. This creates a more inclusive and predictive credit assessment system.

3. Instant Document Verification

AI systems check submitted documents against secure databases in real time. This minimizes the need for manual checks, ensures compliance, and speeds up approvals.

4. AI-Based Underwriting

AI analyzes previous loan data to recognize risk patterns and trends. These predictive models make faster and more accurate underwriting decisions, with less human bias.

5. Real-Time Loan Processing

AI automates everything from risk evaluation to document checks, enabling fast, secure loan approvals and disbursements while ensuring full regulatory compliance.

6. Fraud Detection

Machine learning detects suspicious patterns and inconsistencies in applications. This helps lenders spot potential fraud quickly and minimize risk.

7. High Accuracy and Fairness

AI eliminates emotional or biased decision-making. It uses data to ensure objective and consistent loan approvals.

8. 24/7 Decision-Making

AI doesn’t sleep. It processes loan applications around the clock, improving customer convenience and efficiency for lenders.

Key Features of an AI-Based Loan Approval App

To build a functional and secure AI loan app, you need advanced tools that make borrowing simple, secure, and compliant. Here are the must-have features:

1. User Onboarding & Secure Login

Allow users to register using email or phone with strong authentication tools like OTPs, biometrics, and two-factor verification to keep accounts secure.

2. AI-Powered Credit Analysis

Analyze credit history, financial behavior, and alternative indicators in real time. Use machine learning to provide instant eligibility scores and personalized loan offers.

3. Automated Decision Engine

An AI decision engine should evaluate applications using credit scores, debt ratios, and payment history. It should also allow manual reviews for borderline cases to stay compliant with lending laws.

4. Chatbot & Live Support

An AI chatbot can answer FAQs, help with loan status updates, and guide users through the application. Include options for live chat or phone/email support for complex questions.

5. Top-Notch Security

Use encryption, AI fraud detection, and secure cloud data storage to protect user data. Ensure compliance with regulations like GDPR and PCI DSS.

6. Compliance Management Tools

The app should support legal and financial compliance, including anti-money laundering (AML) laws and fair lending standards. Make consent policies clear and data usage transparent.

Steps to Develop an AI-Based Loan Approval App

Here’s a detailed roadmap for building an AI-powered loan app from start to finish:

1. Define Your Goals & App Features

Start by identifying what you want the app to achieve. Choose your audience and determine must-have features like AI credit scoring and instant approvals.

2. Design UX/UI

Create a simple, intuitive design that guides users from registration to loan approval. Use wireframes and interactive mockups to test the experience before coding begins.

3. Choose the Right Tech Stack

Use robust backend tools like Python (Flask/Django) or Node.js. Pair with frontend frameworks like React, Vue, or Angular. Choose reliable databases such as MongoDB or PostgreSQL.

4. Gather and Process Data

Use historical loan data to train your AI models. Clean and structure the data properly to ensure high prediction accuracy.

5. Train AI Models for Credit Scoring

Apply machine learning methods like decision trees, logistic regression, or neural networks. Train the model with real data, test it using accuracy metrics, and tune it for optimal performance.

6. Implement Document Verification Tools

Integrate OCR and NLP to scan and verify uploaded documents. Connect with external databases for cross-verification to catch errors or fraud.

7. Develop Backend & APIs

Create secure APIs for loan processing, user management, and AI predictions. Ensure real-time data flow between frontend, backend, and your AI model.

8. Build the Frontend Interface

Create a responsive user interface for both mobile and web platforms. Allow users to apply, upload documents, and track their loan status.

9. Add Fraud & Risk Analysis

Use AI to monitor application data for signs of fraud or inconsistencies. Include real-time alerts for anomalies and high-risk behaviors.

10. Launch and Optimize

Deploy the app on secure cloud platforms like AWS, Azure, or Google Cloud. Set up CI/CD pipelines for fast updates. Monitor user feedback, app performance, and retrain AI models regularly for better results.

Development Cost Breakdown (Estimated)

| Step | Task | Cost Estimate (USD) |

|---|---|---|

| Requirements & Scope | Define features and goals | $1,000 – $5,000 |

| UX/UI Design | Wireframes & user flows | $2,000 – $7,000 |

| Tech Stack Selection | Backend, frontend & AI tools | $1,000 – $4,000 |

| Data Prep | Gather and clean financial data | $3,000 – $10,000 |

| AI Credit Scoring Model | Build & train models | $5,000 – $15,000 |

| Document Verification | OCR/NLP integration | $4,000 – $12,000 |

| Backend APIs | User, loan, and AI API setup | $6,000 – $20,000 |

| Frontend Development | UI build and integration | $5,000 – $18,000 |

| Risk & Fraud Detection | AI risk models | $4,000 – $12,000 |

| Testing & Validation | Functional, security, and compliance | $3,000 – $10,000 |

| Deployment | Hosting and CI/CD | $2,000 – $8,000 |

| Monitoring & Model Updates | AI optimization post-launch | $2,000 – $9,000 |

| Compliance & Security | Legal frameworks & data protection | $3,000 – $12,000 |

| Marketing & Support | SEO, ads, and customer setup | $2,000 – $8,000 |

| Total Estimated Cost | $50,000 – $100,000 |

Benefits of AI-Based Loan Approval Apps

1. Faster Loan Processing

What used to take days or weeks can now be completed in minutes, thanks to automation and real-time data analysis.

2. Greater Accuracy

AI improves precision in decision-making by analyzing huge data sets and reducing human errors.

3. Better Risk Management

AI models can quickly flag risky applications and fraudulent behavior, reducing the chance of bad loans.

4. Tailored Loan Offers

AI tailors loan offers by understanding each borrower’s unique financial behavior, helping users find the best-fit loans.

5. Cost Savings

Automation reduces the need for manual labor and customer service agents, significantly cutting operational expenses.

6. 24/7 Access

Borrowers can apply for loans and get approvals at any time, supported by always-on AI chatbots and processing tools.

7. Easy Scalability

AI systems can handle growing demand without extra staff, allowing you to expand your services rapidly and efficiently.

Top 5 AI-Based Loan Approval Platforms

1. Upstart

Uses AI to look beyond credit scores by analyzing education, job history, and more—ideal for young or first-time borrowers.

2. Affirm

Offers real-time financing at the point of sale, with flexible payments and fast credit decisions, great for online shoppers.

3. Fundera

Focuses on small businesses, using AI to analyze cash flow and provide quick, tailored funding solutions.

4. Zest AI

Helps banks and credit unions improve lending accuracy and fairness with custom AI underwriting models.

5. Even

Supports employee financial health by offering early wage access and smart financial recommendations powered by AI.

Final Thoughts

AI-based loan approval apps are revolutionizing the way we borrow and lend. They provide faster decisions, better risk analysis, lower costs, and an overall smoother experience for both lenders and borrowers.

As competition in digital finance increases, adopting AI technology is no longer optional—it’s essential. Investing in AI lending tools today ensures long-term efficiency, customer trust, and a competitive edge in tomorrow’s market.

Join Gen Z New WhatsApp Channel To Stay Updated On time https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30