Kenya’s national debt has now surged to Ksh 11.81 trillion, accounting for 67.8 percent of the country’s Gross Domestic Product (GDP), according to the latest figures released by the National Treasury.

The data further reveals that the government is spending an average of Ksh 4.71 billion every single day on debt repayments, highlighting the growing strain on the country’s financial resources.

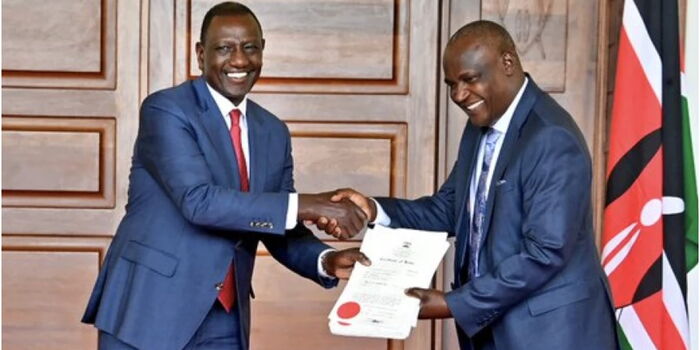

Treasury Cabinet Secretary John Mbadi explained that during the 2024/2025 financial year, the government spent a total of Ksh 1.72 trillion on debt servicing alone.

Out of this amount, Ksh 1.14 trillion went toward paying local lenders such as commercial banks and pension funds, while Ksh 579 billion was used to settle external debts owed to international creditors.

These external lenders include major institutions like the World Bank, African Development Bank (AfDB), China, and Eurobond investors.

Mbadi noted that although Kenya’s debt, when calculated in present value terms, represents 63.7 percent of GDP, it is still considered within the manageable range.

However, he cautioned that the country remains at a high risk of debt distress, meaning that even though Kenya can currently meet its repayment obligations, the situation could become more difficult if not managed prudently.

Out of the total debt, Ksh 6.33 trillion is owed to domestic creditors, while Ksh 5.48 trillion represents external debt.

The Treasury boss emphasized that the government is fully aware of the risks and is actively taking measures to control and restructure its debt profile.

What the Government Is Doing to Manage the Debt

To reduce the country’s debt burden and improve sustainability, Mbadi stated that the Treasury has launched several liability management initiatives, including the refinancing of high-cost loans to obtain more favourable repayment terms.

This involves replacing expensive short-term loans with longer-term and cheaper financing options.

The government is also extending the maturity period of its loans—meaning debts will take longer to fall due—and increasing its use of concessional loans, which come with low-interest rates and flexible repayment terms.

According to Mbadi, this approach is designed to enhance debt sustainability while ensuring that essential government services such as healthcare, education, and infrastructure are not disrupted.

“Under the 2025 Medium-Term Debt Management Strategy, the Treasury’s goal is to lengthen Kenya’s debt repayment period, minimize exposure to rising interest and foreign exchange rate risks, and ensure fairness across generations,” the Treasury said in its statement.

The new strategy also proposes that 75 percent of future borrowing will be raised locally, while the remaining 25 percent will come from external concessional sources.

This balance, the Treasury argues, will help reduce the country’s vulnerability to global financial shocks and currency fluctuations.

Outlook for the Future

Looking ahead, Mbadi expressed optimism that Kenya’s debt-to-GDP ratio will begin to decline gradually over the next few years. This, he said, will be achieved through continued fiscal discipline, structural economic reforms, and improved revenue collection by the Kenya Revenue Authority (KRA).

He added that these reforms are crucial not only for stabilising the country’s economy but also for restoring investor confidence and ensuring Kenya maintains access to affordable credit in international markets.

Mbadi further noted that the government is committed to implementing sound financial management practices even as global interest rates rise, emphasizing that responsible borrowing and efficient use of resources will remain at the heart of Kenya’s economic recovery strategy.

In summary, while Kenya’s debt level has reached an all-time high, the Treasury insists that the situation is under control, and with the right policy measures in place, the country is expected to move towards a more sustainable and stable fiscal future.

Join Government Official WhatsApp Channel To Stay Updated On time

https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30