Government to Review Taxes in Next Finance Bill

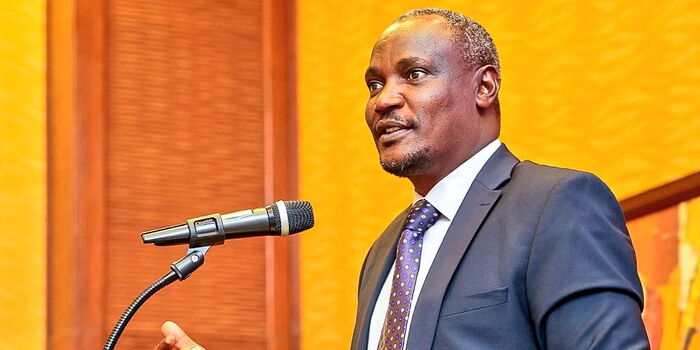

Treasury Cabinet Secretary John Mbadi has announced that the government is planning to revise the Pay As You Earn (PAYE) tax system and make other important tax adjustments to avoid placing too much financial strain on Kenyan workers.

While addressing Senators during a session on Tuesday, Mbadi revealed that the government had originally intended to include these changes in the current Finance Bill.

However, they were unable to do so due to certain limitations, especially the failure of the Kenya Revenue Authority (KRA) to meet its revenue collection targets.

Because of this shortfall, the adjustments to PAYE have been postponed and will now be introduced in the next Finance Bill.

The main goal is to ensure that Kenyans can retain more of their income after taxes, giving them higher disposable income—this refers to the money that individuals or households have left to spend or save after paying taxes.

“We were unable to make major tax adjustments this time around, and we acknowledge that doing so would negatively impact taxpayers by reducing their take-home pay. While we had committed to reviewing this, the circumstances did not allow it.

That said, we cannot afford to further reduce Kenyans’ disposable income,” Mbadi explained.

In addition to changes in PAYE, the CS also announced plans to lower the corporate tax rate from 30% to 28% in the next Finance Bill. This move is aimed at making Kenya a more attractive destination for investment, as businesses will be able to keep more of their profits.

The hope is that this will motivate both local and foreign companies to grow their operations, which could lead to job creation and an overall boost in economic growth.

“When drafting the Finance Bill, we ran simulations to explore how to reduce PAYE, but the failure by KRA to achieve its targets made it impossible to implement the changes at this time. We will revisit this in the upcoming Finance Bill, alongside the proposal to lower corporate tax,” said Mbadi.

However, he acknowledged that lowering corporate tax might cause short-term revenue losses for the government.

If this drop in tax collection is not balanced out by increased business activity or better tax compliance, there could be less money available to fund essential public services like healthcare, education, and infrastructure.

This makes it critical for the government to time these changes carefully and introduce supportive reforms, such as improving the efficiency of revenue collection.

Mbadi mentioned that the government is already making internal reforms at KRA but stressed the importance of not overwhelming the institution by trying to do too much at once.

Meanwhile, the CS also indicated that Kenyans can expect further announcements regarding the Housing Levy. He hinted that the government is reviewing the current deductions, with a possibility of reducing them to lessen the burden on salaried employees.

“There are ongoing discussions about making changes to the Housing Levy. While it brings long-term benefits, we have heard significant concerns from workers whose pay slips have been heavily affected,” he added.

Mbadi also mentioned that there are plans to revise the Road Maintenance Levy (RMF), which currently stands at Ksh18 per litre at the fuel pump. Any adjustments made to this levy would likely impact fuel prices across the country.

In summary, the government is considering a comprehensive package of tax reforms aimed at easing pressure on ordinary Kenyans while still promoting economic growth and attracting investment.

However, the success of these efforts will depend heavily on improved tax collection and the careful management of fiscal policies.

Join Gen Z New WhatsApp Channel To Stay Updated On time https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30