Borrowing money without putting up any collateral might sound impossible, but thanks to blockchain innovation — specifically flash loans — it’s now a reality. However, while this concept is fascinating, it remains risky and limited compared to more stable options like Bitcoin-backed loans.

This complete guide explains how no-collateral crypto loans work, the potential dangers involved, and why Ledn’s B2X might be a smarter, safer alternative for anyone looking to grow their crypto portfolio responsibly.

What Are Crypto Loans?

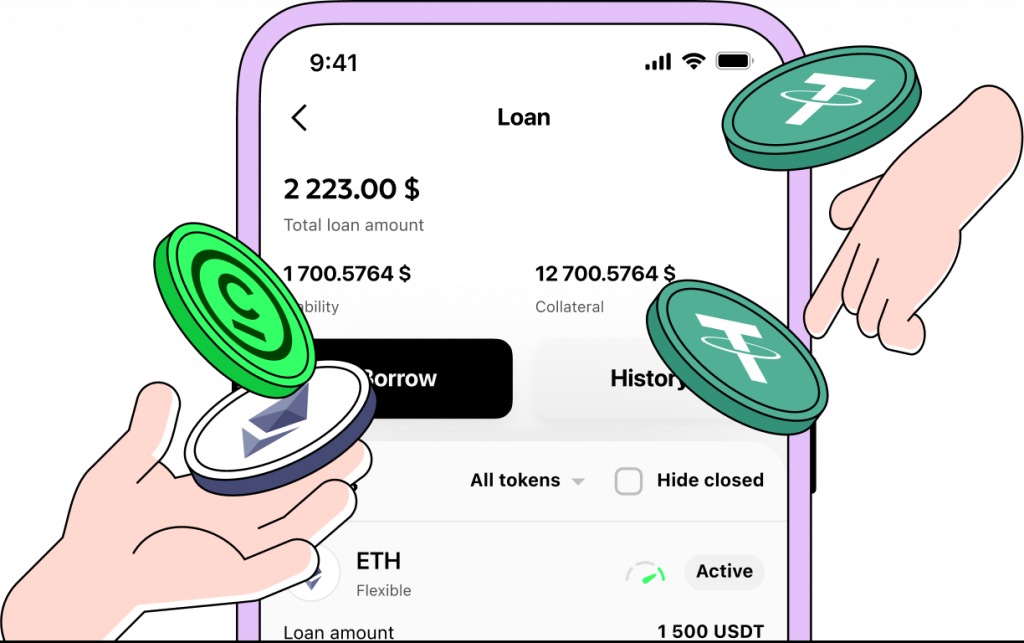

Crypto loans allow you to borrow digital assets or even traditional currency by using your cryptocurrency as collateral. Essentially, you deposit Bitcoin or another supported asset, and in return, you receive a loan — usually in fiat or stablecoins like USDC.

Most crypto lending platforms operate in this space and typically offer:

- Bitcoin-backed loans (e.g., Ledn’s B2X)

- Stablecoin loans (borrow USDC, USDT, etc.)

- Fiat loans backed by crypto collateral

Unlike traditional bank loans, crypto loans don’t require a credit score or credit check. The entire process is automated and based on the value of your collateral, making it fast and accessible. Approvals are often instant because everything runs on smart contracts or centralized lending systems.

If you want to dive deeper, you can check out a full Crypto Lending Guide, which explains this growing sector in more detail.

What Are Crypto Loans Without Collateral?

A no-collateral crypto loan means you borrow funds without providing any security upfront. The most common example of this type is the flash loan — a unique DeFi product that enables borrowing and repayment within the same blockchain transaction.

These loans are powered entirely by smart contracts, and you’ll only find them in decentralized finance (DeFi) systems — not in centralized platforms like Ledn or Nexo.

How Do Flash Loans Work?

Flash loans let you borrow large amounts of crypto instantly — but only for a few seconds (or more precisely, one blockchain block).

Here’s a simplified explanation:

- A smart contract creates the loan.

- You use the borrowed funds (for arbitrage, liquidation, or trading).

- You repay the loan — all within the same transaction.

If repayment fails, the entire transaction is automatically canceled, leaving no trace or loss. This setup protects lenders but gives borrowers almost zero flexibility.

In short: Flash loans are a powerful but technical tool, suitable only for advanced users or developers who know how to interact with DeFi protocols safely.

Flash Loans vs. Crypto-Backed Loans

| Feature | Flash Loan (No Collateral) | Crypto-Backed Loan (e.g. B2X) |

|---|---|---|

| Requires programming knowledge | Yes | No |

| Suitable for beginners | No | Yes |

| Loan duration | Seconds | Up to 12 months |

| Risk of technical failure | High | Low |

| Collateral required | None | Yes (e.g., Bitcoin) |

| Primary use case | Arbitrage, DeFi trading | Long-term Bitcoin exposure |

| Platform type | DeFi (Decentralized) | CeFi (Centralized, e.g. Ledn) |

If you’re looking for something safer and easier to manage, Ledn’s B2X allows you to borrow against your Bitcoin and increase your holdings under stable, predictable conditions — ideal for long-term crypto investors.

Why Most Crypto Loans Require Collateral

Crypto lending platforms usually ask for collateral because:

- Borrowers have no credit score or track record on the blockchain.

- Collateral acts as security if a borrower defaults.

- It allows lenders to offer lower interest rates.

In simple terms, collateral ensures trust in an otherwise trustless system. Without it, lenders take on significant risk.

Why Crypto Loans Are Often Over-Collateralized

Unlike banks, most crypto lenders require borrowers to lock up more value than they borrow. For example, to borrow $5,000, you might need to deposit $8,000 in Bitcoin.

This over-collateralization happens because:

- Borrowers are pseudonymous, not fully identifiable.

- Instant approvals mean no time for background checks.

- Crypto volatility demands a safety buffer.

Platforms like Ledn use over-collateralization to maintain user privacy while keeping lending stable and secure.

The Risks of Under-Collateralized and Flash Loans

While no-collateral loans sound appealing, they carry serious risks:

- Smart contract bugs or vulnerabilities can lead to total loss.

- There’s no legal protection — most DeFi projects are unregulated and pseudonymous.

- Borrowers must have strong technical knowledge to use these tools properly.

- Flash loans depend heavily on timing and market conditions — one delay can cause a transaction to fail.

- Poorly written smart contracts are often targets for hackers and exploiters.

Flash loans are great for short-term arbitrage or trading strategies but not for regular borrowing, liquidity management, or long-term investment.

Outside of DeFi, some under-collateralized loans exist, but they usually involve high interest rates, long approval times, and strict KYC checks — defeating the very purpose of using crypto loans in the first place.

Where to Get a Crypto Loan Without Collateral

If you still want to explore non-collateralized loans, here are a few popular DeFi platforms to research (always DYOR — Do Your Own Research before using them):

- Aave – One of the oldest and most trusted DeFi protocols. It offers flash loans on Ethereum and supports many crypto assets.

- Equalizer Finance – Specializes in flash loans for developers and algorithmic traders. It supports multiple chains like Ethereum, BNB Chain, and Polygon.

- Uniswap – A decentralized exchange that also provides Flash Swaps, allowing users to borrow liquidity within a single transaction.

⚠️ Caution: These platforms are designed for advanced users. Misuse or misunderstanding of flash loans can lead to complete loss of funds.

Why Ledn Doesn’t Offer Flash Loans

Ledn focuses on offering secure, long-term financial products, not speculative or high-risk DeFi tools. Flash loans don’t fit its philosophy because they:

- Require repayment within seconds.

- Offer no flexibility for normal users.

- Depend entirely on smart contract code.

- Operate in an unregulated environment with no legal safeguards.

Instead, Ledn provides transparent, stable, and regulated services such as Bitcoin-backed loans, allowing users to borrow confidently with predictable outcomes.

A Better Alternative: Ledn B2X

Ledn’s B2X product is built for Bitcoin holders who want to expand their position safely. Here’s how it works:

- You use your Bitcoin as collateral.

- You receive a loan in fiat, which you can use to buy more Bitcoin.

- This effectively doubles your Bitcoin exposure without selling any.

- There are no credit checks, and the process is straightforward.

- Loan terms last up to 12 months, with flexible repayment options.

It’s a practical and beginner-friendly way to grow your crypto holdings without the complexity or danger of flash loans.

You can try the B2X Calculator on Ledn’s website to see how much you could borrow and how your position would look after doubling.

Final Thoughts

No-collateral crypto loans are possible, but they’re not for everyone. Flash loans are powerful, but they carry enormous risks and require advanced blockchain expertise.

For most users — especially long-term Bitcoin holders — a secured loan like Ledn’s B2X offers a far better balance of safety, simplicity, and growth potential.

It’s a dependable way to use your Bitcoin to generate wealth, without giving up control or exposing yourself to unnecessary risk.

Visit ledn.io to explore how much you can borrow, preview your loan terms, and start growing your digital assets responsibly.

Join Government Official WhatsApp Channel To Stay Updated On time

https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30