Introduction

As the digital asset market matures, institutional investors are seeking new ways to leverage their crypto holdings. One of the fastest-growing solutions in this space is crypto loan origination platforms.

These platforms allow institutions to borrow or lend digital assets securely and efficiently. With increasing demand for liquidity and yield, crypto loans have become an attractive tool for asset management, hedging strategies, and market participation.

What Are Crypto Loan Origination Platforms?

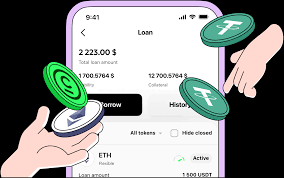

Crypto loan origination platforms are digital platforms that facilitate the issuance and management of cryptocurrency-backed loans. For institutional investors, these platforms provide a secure environment to borrow or lend large amounts of crypto or fiat using digital assets as collateral.

Unlike retail lending apps, institutional-grade platforms are built with higher standards of compliance, risk management, and scalability.

How Do They Work?

At a basic level, these platforms work in a few key steps:

- Collateral Deposit: Borrowers deposit digital assets like Bitcoin or Ethereum as collateral.

- Loan Issuance: Based on the collateral value, the platform issues a loan in crypto or fiat currency (like USDT, USDC, or USD).

- Smart Contracts or Custody Agreements: The terms are managed either through smart contracts or traditional legal frameworks, especially for large transactions.

- Interest Payments and Repayment: Borrowers repay the loan with interest over a set term. If they default, the collateral is liquidated.

Why Institutional Investors Are Interested

1. Access to Liquidity

Institutions often hold large positions in crypto. These platforms allow them to unlock liquidity without selling their assets. This is ideal for hedge funds, family offices, and asset managers looking to maintain long-term positions while meeting short-term cash needs.

2. Attractive Yields

On the lending side, institutions can earn passive income by providing capital to borrowers. Compared to traditional fixed-income products, crypto loan interest rates are often more lucrative.

3. Customizable Terms

Institutional platforms offer flexible loan terms, large borrowing limits, and customized agreements tailored to specific risk appetites and investment strategies.

4. Collateral Management

Institutions benefit from robust risk controls, including over-collateralization, real-time margin monitoring, and third-party custodians to reduce counterparty risk.

Leading Platforms Serving Institutions

Some of the top crypto loan origination platforms focused on institutions include:

- Genesis Global (Note: Faced challenges in 2023 but was a major player)

- BlockFi Institutional Services (before its restructuring)

- Celsius Network (institutional arm, though it also had bankruptcy issues)

- Nexo Pro

- Matrixport

- LedgerPrime

- Anchorage Digital

- Clearpool (offers decentralized lending to institutions)

Many of these platforms combine traditional finance structures with blockchain-based automation to offer hybrid models of lending.

Centralized vs. Decentralized Loan Platforms

- Centralized Platforms: Typically offer better customer service, tailored deals, and are often regulated or operate under legal frameworks.

- Decentralized Platforms (DeFi): Such as Aave Arc or Maple Finance, offer transparent, blockchain-based lending but require technical knowledge and are subject to smart contract risks.

Some institutional players prefer DeFi platforms due to their transparency and composability but still demand KYC and whitelisted pools to reduce risk.

Risks and Considerations

Despite the benefits, there are several risks:

- Market Volatility: If the value of collateral drops suddenly, borrowers may face liquidation.

- Counterparty Risk: Even with institutional-grade platforms, there’s always a risk of defaults or insolvency.

- Regulatory Uncertainty: Crypto lending is under increasing regulatory scrutiny in several jurisdictions.

- Custody Security: Institutions require highly secure custody solutions to protect digital assets.

To mitigate these risks, institutions often use third-party custodians, insurance solutions, and legal contracts.

The Future of Crypto Loan Origination for Institutions

The market for institutional crypto lending is expected to grow as the overall crypto space becomes more regulated and integrated with traditional finance. With banks, hedge funds, and even governments exploring digital assets, demand for transparent and secure loan origination platforms will likely increase.

Innovations like tokenized treasuries, real-world asset (RWA) lending, and cross-chain collateralization will continue to shape the future of crypto finance. Platforms that offer regulatory clarity, strong compliance frameworks, and technological innovation will lead the way.

Join Gen Z New WhatsApp Channel To Stay Updated On time

https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30