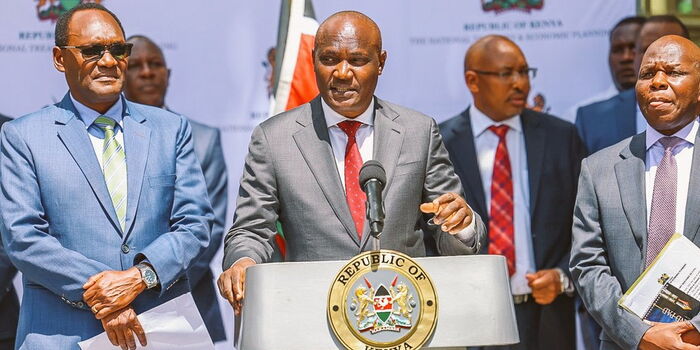

Kenya is set to receive a fresh loan of Ksh122 billion from international lenders, according to Treasury Cabinet Secretary John Mbadi.

Speaking to Reuters, Mbadi disclosed that the government is also considering a $1.5 billion (approximately Ksh193 billion) privately placed bond in the United Arab Emirates (UAE) to help finance the national budget for the current financial year.

UAE Loan Temporarily Put on Hold

The UAE loan, which was expected to be disbursed in a single installment this week, has now been put on hold. According to Bloomberg, the Kenyan government has decided to pause the loan as it reviews the budget deficit and ongoing financial commitments.

Mbadi explained that the delay is aimed at ensuring the loan aligns with the country’s fiscal strategy. “We are still holding out to see exactly how much budget gap we will still have from external finances before we draw the (UAE) money,” he stated.

He further clarified that the decision to delay the loan disbursement is meant to allow the government to integrate it effectively into the national fiscal framework. “The reason why we have not taken it yet is that we need to ensure it fits within our financial plan,” Mbadi told Reuters on Friday.

Purpose of the Loan

The funds from the UAE will be used for both liability management and budgetary support. This means the government may allocate part of the money to settle maturing debts while the rest will be used to fund government expenditure.

“We can use it partly for liability management, partly for budgetary support, or exclusively for budgetary support,” Mbadi explained.

According to him, the loan agreement between Kenya and the UAE was finalized last year. It carries an interest rate of 8.25%, with repayments scheduled in three equal installments of $500 million (about Ksh89.95 billion at the current exchange rate). These payments will be made in 2032, 2034, and 2036.

More Loans Expected from International Partners

Besides the UAE loan, Kenya is also expecting over $950 million (approximately Ksh122 billion) from various international financial institutions before the end of June.

The funds will come from multiple sources, including the World Bank, the African Development Bank (AfDB), and bilateral partners such as Italy and Germany.

Last year, Kenya secured a $200 million (about Ksh25.7 billion) loan from the AfDB and also entered discussions with the World Bank for an additional $750 million (about Ksh96.4 billion). While it remains unclear if an agreement has been reached with the World Bank, the government is optimistic about receiving the funds.

These external loans are expected to provide significant financial relief to Kenya by helping the government manage its debts and finance key budgetary needs.

Join all Counties official Whatsapp Channel To Stay Updated On time https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30