In the fast-changing world of crypto finance, maintaining privacy while ensuring trust is a major challenge. This is especially true in crypto lending, where borrowers and lenders must trust each other—but may also want to keep their financial details private.

A powerful solution is now emerging through Zero-Knowledge Proofs (ZKPs), a cryptographic technology that enables verification without revealing sensitive information. Let’s explore how ZKPs are reshaping the future of confidential crypto lending.

What Are Zero-Knowledge Proofs?

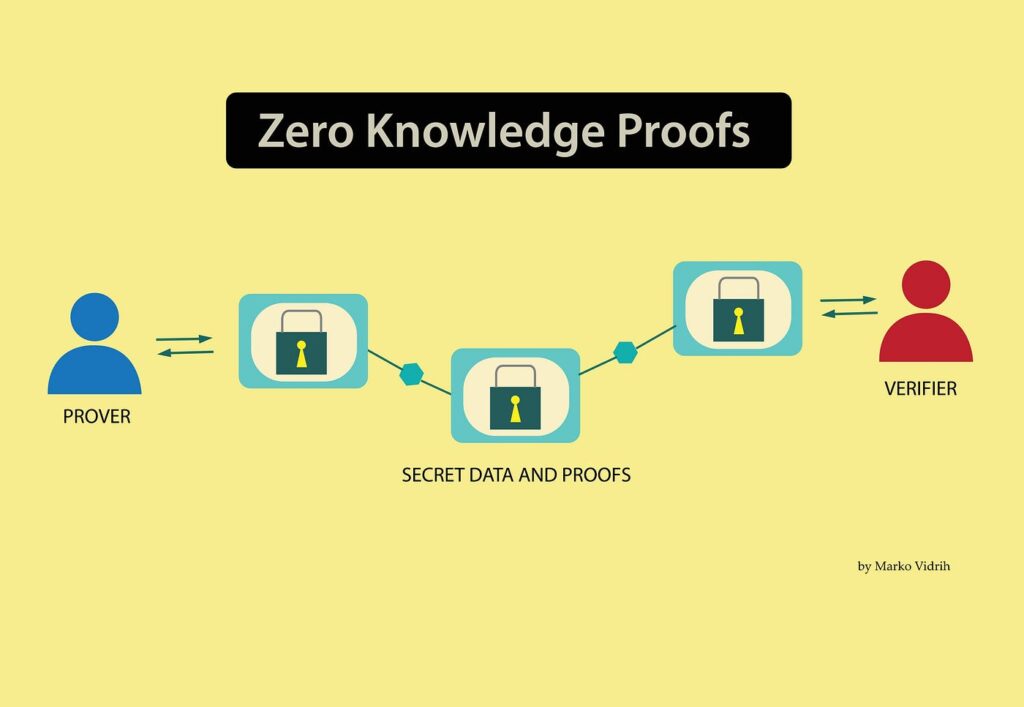

Zero-Knowledge Proofs are cryptographic methods that allow one party (the “prover”) to prove to another party (the “verifier”) that something is true—without revealing the actual information.

For example, if someone wants to prove they have enough collateral to get a loan, a ZKP can prove this without showing the actual amount of crypto they hold. It sounds like magic, but it’s based on advanced mathematics and encryption techniques.

There are different types of ZKPs, including:

- Interactive ZKPs: Require back-and-forth communication between prover and verifier.

- Non-interactive ZKPs: Allow proof to be verified without further interaction, which is more practical in decentralized finance (DeFi).

- ZK-SNARKs and ZK-STARKs: Two leading frameworks for implementing zero-knowledge systems efficiently and securely.

Why Confidentiality Matters in Crypto Lending

Crypto lending allows users to borrow digital assets by locking up crypto as collateral. However, traditional blockchain transactions are public, meaning anyone can see your wallet balance and lending activity. This lack of privacy poses several issues:

- Exposure of financial positions: Large holders may become targets.

- Front-running and manipulation: Observers can exploit public data to their advantage.

- Regulatory and business confidentiality: Institutions may not want to reveal lending details.

To address these concerns, lenders and borrowers need a way to verify creditworthiness and collateral without making their private financial data public. This is where ZKPs play a vital role.

How ZKPs Enable Confidential Crypto Lending

Zero-Knowledge Proofs can enhance crypto lending platforms by ensuring that all necessary checks are performed—like verifying a borrower’s collateral or trust score—without exposing the underlying data.

Here’s how it works in practice:

1. Collateral Verification Without Disclosure

A borrower can use a ZKP to prove they have locked enough collateral in a smart contract without revealing the type or amount of tokens.

2. Credit Score Privacy

If a platform uses decentralized identity or on-chain credit scoring, users can prove they meet minimum requirements without exposing their full history.

3. Confidential Loan Terms

ZKPs can also be used to prove compliance with interest rate limits, repayment deadlines, or other contract terms without revealing them publicly.

Benefits for Lenders and Borrowers

- Privacy: Users don’t need to reveal wallet contents, transaction history, or identities.

- Security: Reduces the risk of data leaks and targeted attacks.

- Compliance: Makes it easier for platforms to meet privacy regulations like GDPR.

- Trustless Verification: Enables DeFi platforms to verify facts on-chain without relying on third parties.

Real-World Projects and Use Cases

Several blockchain projects are already exploring ZKPs for private lending:

- Aleo and Mina Protocol are building blockchains with native zero-knowledge capabilities.

- Aztec and Zcash implement ZKPs for private transactions, which could be adapted for lending.

- Credora (formerly X-Margin) uses zero-knowledge proofs to assess credit risk in a privacy-preserving way for institutions.

These platforms show how ZKPs can be used not just for privacy, but also to bring transparency and efficiency to lending—without the trade-off of exposure.

Challenges and Limitations

While promising, ZKPs come with challenges:

- Computational Complexity: Some ZKPs require heavy computation, which can slow down blockchain performance.

- Developer Difficulty: Building secure ZKPs requires advanced cryptographic skills.

- Scalability: Ensuring fast, affordable transactions while using ZKPs is still a work in progress.

However, ongoing innovation is addressing these issues. Frameworks like zkSync, StarkWare, and Polygon Zero are making ZKPs faster and more accessible.

The Future of Private Lending in DeFi

As DeFi matures, privacy will become just as important as decentralization. ZKPs offer a way to achieve both. They enable platforms to verify identity, collateral, and creditworthiness in a trustless and confidential manner.

In the near future, we can expect to see:

- Fully private loan marketplaces

- Cross-chain ZKP integrations

- Institutional DeFi solutions using ZKPs for regulatory compliance

By combining strong privacy with verifiable trust, Zero-Knowledge Proofs are set to revolutionize crypto lending—and may eventually redefine how finance works in the decentralized world.

Final Thoughts

Zero-Knowledge Proofs are more than just a privacy tool—they are a breakthrough for the future of decentralized lending.

As DeFi continues to grow, solutions like ZKPs will be essential for building secure, private, and trustworthy lending systems. Whether you’re a borrower who values privacy or a lender seeking confidence without risk, ZKPs may hold the key to a better, more private crypto economy.

Join Gen Z & Millennials New WhatsApp Channel To Stay Updated On time

https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30