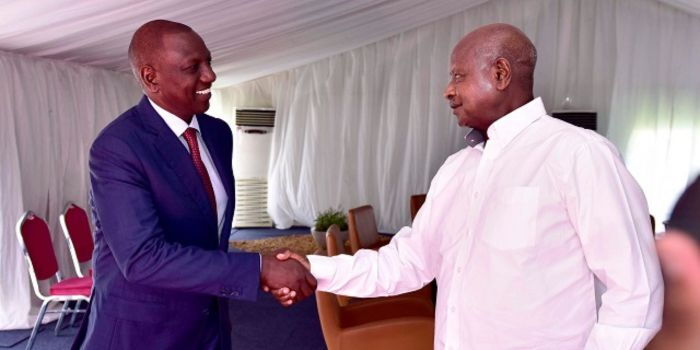

CS Wandayi Reveals Uganda’s Role in Disrupting G-to-G Fuel Import Plan

Energy and Petroleum Cabinet Secretary Opiyo Wandayi has blamed Uganda for interfering with the smooth rollout of Kenya’s multi-billion-shilling Government-to-Government (G-to-G) oil importation agreement.

While speaking before the National Assembly’s Departmental Committee on Energy, Wandayi said that Uganda’s recent move to begin independently importing refined petroleum through the Uganda National Oil Company had negatively impacted the consistent delivery of oil shipments to Kenya under the deal.

According to Wandayi, Uganda’s unilateral decision disrupted the expected monthly oil deliveries, reducing the number of consignments coming into Kenya. As a result, the initially agreed timelines for completing the remaining oil imports under the contract were thrown off course.

“In response to this disruption, Cabinet resolved to extend the G-to-G oil import deal for another 24 months once the current agreement comes to an end,” Wandayi explained.

He highlighted that the G-to-G oil importation deal was first introduced at a time when Kenya was under heavy pressure due to declining foreign exchange reserves, and the country needed a new strategy to manage fuel imports more sustainably.

Wandayi emphasized that the deal with the three Gulf-based oil suppliers had already shown positive results by helping to lower fuel pump prices across the country.

He went on to describe the key goals of the G-to-G oil deal, which include easing the strain on the US dollar supply, bringing back stability to the interbank foreign exchange market, and maintaining a more stable exchange rate.

“Before the deal was put in place, Kenya used to pay for all its petroleum imports in US dollars, which worsened the shortage of dollars in the market,” he noted.

Wandayi added that the newly extended agreement is expected to run until early 2028, by which time the economy is projected to be more stable and resilient.

The CS also addressed the recent rise in fuel prices, pointing to a sharp increase in global oil prices driven largely by the ongoing conflict in the Middle East.

He provided specific figures, revealing that between May and June 2025, international oil prices went up significantly: Super Petrol rose by 6.72%, Diesel by 9.33%, and Kerosene by 8.15%.

During the committee session, several Members of Parliament demanded transparency and accountability over how Ksh25 billion from the Petroleum Development Levy—allocated in the current national budget—was spent.

Join Gen Z New WhatsApp Channel To Stay Updated On time https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30