How to Borrow Up to Ksh1 Million Instantly on the New KCB Mobile App

KCB Bank has upgraded its mobile banking app as part of its commitment to the slogan “For People, For Better.” With this new version, Kenyans can now access every KCB service directly from their phones — including quick and flexible loan products built for modern financial needs.

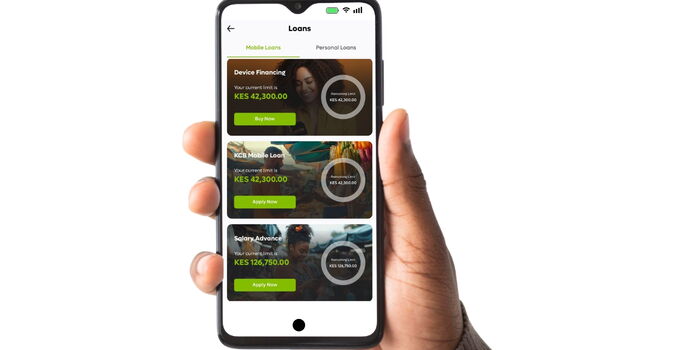

The revamped New KCB Mobile App gives customers full access to the bank’s loan options in one place. It is designed to make borrowing easier, faster, and more convenient. Whether you want to explore loan limits, apply for credit, or track ongoing repayments, everything is available in just a few taps.

The app acts as a complete digital banking platform that lets users open new accounts, send money, pay bills, save, track expenses, and manage finances from wherever they are. It has been redesigned to deliver speed, safety, and a smooth experience that fits the lifestyle of everyday Kenyans.

One of the biggest advantages of this upgrade is the ability to borrow digital loans of up to Ksh1 million instantly. Whether you’re responding to an emergency, planning a major purchase such as a car, or simply need extra cash flow, the app places reliable credit options at your fingertips.

KCB offers several loan products with flexible terms and competitive interest rates. These include the KCB Flexi Loan, which allows customers to borrow up to Ksh1 million right from the app and repay within a period ranging from one day to one year. There is also the KCB Salary Advance, a short-term solution for salaried customers that offers up to 100% of your monthly salary.

The bank has additional secured and unsecured loan options. Secured loans require collateral, such as the Personal Car Loan, while unsecured loans do not require any security apart from employer support where applicable. A good example is the Masomo Loan, which supports education financing.

This article breaks down each loan type, including their requirements and benefits, to help you choose the best option for your financial needs.

KCB Flexi Loan — Requirements & Benefits

The Flexi Loan is one of the easiest and most convenient borrowing options available on the new KCB Mobile App. It is extremely flexible, allowing customers to borrow multiple small loans as long as they remain within their approved limit.

For example, you can borrow Ksh5,000 on Monday, Ksh3,000 on Wednesday, and Ksh2,000 on Saturday, and still get instant approvals as long as the total amount does not go beyond your assigned limit.

The Flexi Loan offers amounts starting from Ksh1,000 all the way to Ksh1 million, depending on your individual limit.

One of its biggest strengths is flexible repayment. Borrowers can choose repayment periods from 1 day to 12 months, and interest varies depending on how quickly you choose to pay. Short-term loans — especially those paid within 1 to 7 days — come with much lower interest charges.

Requirements

- You must have operated a KCB account for at least 6 months

- You must have the New KCB Mobile App installed

- You need a good credit score

Benefits

- Fast and fully digital processing

- Flexible repayment timelines

- Instant approval and disbursement

- Interest rates as low as 1.2% depending on repayment period

KCB Salary Advance — Benefits & Requirements

When cash is tight and you cannot wait for your salary at the end of the month, the KCB Salary Advance becomes a reliable option. It is designed to give quick financial relief to salaried KCB customers.

The loan provides up to Ksh500,000, which is capped at 1.5 times your salary, and funds are deposited straight to your phone in minutes.

Benefits

- Quick access to cash

- Very simple application process

- Helps solve short-term financial gaps

- Near-instant disbursement through the mobile app

Requirements

- You must be a salaried KCB account holder

- Your account must be active for at least 3 months

- Available directly on the KCB Mobile App

KCB Unsecured Loans — Types, Benefits & Requirements

Unsecured loans are some of the most popular loan products in Kenya because they do not require collateral. KCB relies on a customer’s creditworthiness — including income, credit score, and financial behavior — to determine eligibility.

Here are the main unsecured options:

1. Personal Unsecured Non-Check-Off Loan

This loan offers up to Ksh4 million without the need for collateral. Repayment goes up to 48 months, giving customers plenty of time to manage their installments.

Both salaried and self-employed customers can access the loan as long as they have maintained a KCB account for at least 3 months.

You can borrow amounts starting from Ksh20,000.

Benefits:

- No collateral needed

- Long repayment period

- Flexible loan amounts

2. Personal Unsecured Check-Off Loan

This long-term loan is designed for employees whose employers have an agreement with KCB, including government workers. It does not require security, only an employer’s guarantee.

Customers can borrow up to Ksh10 million, repayable in up to 10 years. Repayment is made through monthly deductions from your salary.

Requirements:

- National ID or passport

- KRA PIN

- Filled loan application form

- Latest three months’ original payslips

Benefits:

- Very convenient repayment

- Easy to qualify if your employer has a check-off agreement

- High borrowing limits

3. Masomo Loan

The Masomo Loan supports students who need help financing their education locally or abroad. It covers tuition fees and related academic expenses.

KCB offers between Ksh100,000 and Ksh4 million, depending on your credit score and financial status. The repayment period is up to 24 months, giving borrowers time to focus on studies before repaying.

Requirements:

- Active KCB account for at least 3 months

- Must be salaried or have a guardian

- Valid ID or passport

- Latest original payslips or proof of income

- Admission letter from the learning institution

Benefits:

- Quick processing

- Loan structure that supports students’ repayment ability

KCB Secured Loans — Types, Benefits & Requirements

Secured loans are backed by collateral such as a vehicle, land, or house. They offer higher loan limits and lower interest rates because the bank has security.

KCB provides several secured loan products:

1. Personal Secured Loan

This loan is based on the value of the asset you use as security. For example, if your car is valued at Ksh2.5 million, that becomes your maximum loan limit.

It is open to both salaried and self-employed customers with repayment periods of up to 10 years.

Requirements:

- Valid ID or passport

- KRA PIN

- Completed application form

- Proof of ownership of the security

Benefits:

- Competitive interest rates

- Long repayment timelines

2. Personal Car Loan

KCB offers a wide range of car financing options, including both

full (100%) and partial financing depending on the vehicle and intended use.

Examples:

- School buses: 100% financing for up to 72 months

- Toyota Hiace (matatu): 100% financing for up to 36 months

- Personal cars like VW Touareg: Up to 95% financing with a 60-month repayment period

Requirements:

- Available for salaried and self-employed customers

Benefits:

- Flexible repayment

- High financing limits based on the vehicle value

Download the New KCB Mobile App

The New KCB Mobile App is available on both the Google Play Store and the Apple App Store. New customers can even open a KCB account directly from the app — a process that takes only a few minutes.

With its redesigned loan features and improved digital tools, the app positions itself as one of the most powerful mobile banking platforms in Kenya today.

Join Government Official WhatsApp Channel To Stay Updated On time

https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30