A recent audit of the Hustler Fund for the financial year 2023/2024, conducted by Auditor General Nancy Gathungu, has uncovered significant irregularities regarding the beneficiaries’ ages.

The report revealed that a staggering Ksh 31.8 million was disbursed to 44,167 underage beneficiaries, including some as young as 10 days old, and even unborn individuals with birth dates set between July 2024 and December 2073.

The findings show that 1,186 children, ranging from as young as 10 days to 17 years old, received a total of Ksh 681,395 from the Hustler Fund.

Additionally, 42,981 individuals with birth dates in the future received Ksh 31,135,690. These numbers raise concerns about the accuracy of the records, with many beneficiaries failing to meet the mandatory age requirement of 18 years.

According to the Auditor General, loan agreements with underage beneficiaries are invalid and unenforceable, leading to a higher likelihood of loan defaults. Gathungu also pointed out that the records in the system were unreliable and lacked proper controls.

The report stated that some individuals listed in the database were underage, while others had future birth dates, beyond June 2024, making them ineligible for loans under the current rules.

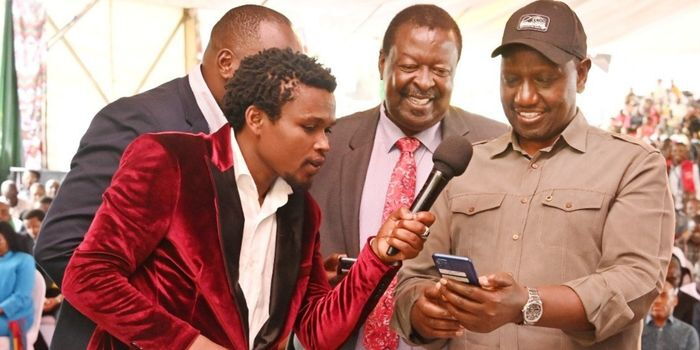

The Hustler Fund, launched by President William Ruto in 2022, was meant to provide accessible financial support to small businesses and entrepreneurs across Kenya. It offers various loan products, including personal loans, microloans, SME loans, and startup loans.

The personal loans range from Ksh 500 to Ksh 50,000, depending on the applicant’s credit score, while SMEs and startups can access up to Ksh 250,000.

To qualify for a loan, applicants must be Kenyan citizens aged 18 years or older, with a valid national ID and a registered mobile number. However, many of the beneficiaries in the audit report did not meet these criteria, raising serious questions about the integrity of the loan distribution system.

In addition to the issues with underage beneficiaries, the Auditor General revealed that a significant portion of the fund’s loans remain unpaid.

As of June 30, 2024, approximately Ksh 9 billion in loan receivables had been outstanding for over a year. The report also highlighted that 1,041 accounts with unpaid loan balances were closed. These loans, totaling Ksh 1.5 million, were closed after only Ksh 646,870 had been repaid.

The report further disclosed that around Ksh 8.7 billion, or 64% of the total loan receivables as of June 2024, were overdue by more than a year, casting doubt on the recovery of these funds.

Last December, President Ruto announced that more than two million borrowers would have their borrowing limits increased by as much as 300%, a move intended to boost the fund’s impact.

However, the findings of this audit suggest that without addressing these irregularities, the future of the Hustler Fund may be at risk.

Join Gen Z official Whatsapp Channel To Stay Updated On time the ongoing situation https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30