One of the main reasons why many people are attracted to forex trading compared to other financial markets is because forex allows for much higher leverage.

Unlike stocks, where you might be limited to borrowing twice your money (2:1 leverage), forex brokers can offer you the ability to control huge amounts of money with just a small deposit.

But while the word leverage may sound attractive, many traders don’t fully understand what it means, how it works, or how it can affect their profits or losses.

In this article, we’ll break down what leverage really is, how it can help or hurt you in forex trading, and why it’s often called a double-edged sword.

What Is Leverage in Forex?

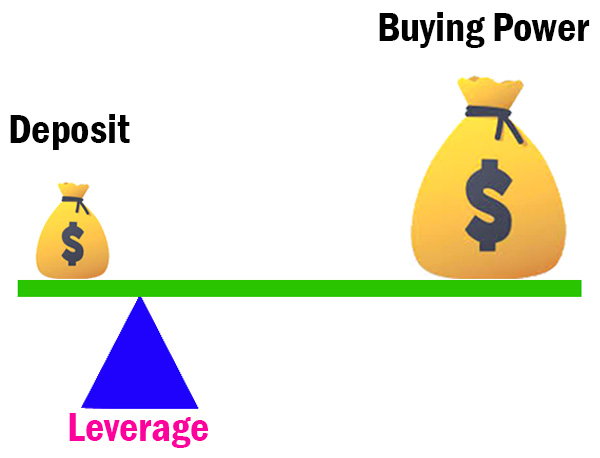

Leverage in forex is simply the ability to control a large amount of money using very little of your own funds and borrowing the rest—usually from your broker. This allows you to make larger trades than you could with only your own money.

Think of leverage as using borrowed capital to increase your trading power. For example, if you have $1,000 and you use 100:1 leverage, you can trade a position worth $100,000.

Key Points About Forex Leverage

- Leverage allows you to open larger positions than your actual account balance.

- Margin trading is how brokers let you borrow money to trade with leverage.

- Forex traders use leverage to benefit from small changes in currency prices.

- Higher leverage can lead to bigger profits—but also larger losses.

Margin-Based Leverage vs. Real Leverage

Margin-Based Leverage

This is the ratio of the total value of your trade to the amount of margin you are required to deposit.

Here’s the formula:

Margin-Based Leverage = Total Trade Value / Margin Required

Example:

If you want to trade $100,000 worth of USD/CHF and your broker only requires you to put up $1,000 as margin, the leverage is:

$100,000 ÷ $1,000 = 100:1

Here’s a table that shows common leverage ratios and their corresponding margin requirements:

| Leverage | Margin Required |

|---|---|

| 400:1 | 0.25% |

| 200:1 | 0.50% |

| 100:1 | 1.00% |

| 50:1 | 2.00% |

Real Leverage

Real leverage, on the other hand, is a better indicator of your true risk because it compares the total value of your open positions with your actual trading capital.

Real Leverage = Total Trade Value / Trading Capital

Example:

If your account has $10,000 and you open a trade worth $100,000, your real leverage is:

$100,000 ÷ $10,000 = 10:1

If you trade $200,000 with the same $10,000 capital, your leverage increases to 20:1.

Why Real Leverage Is Important

Margin-based leverage only tells you how much you could borrow. Real leverage shows how much you are borrowing. Even though a broker might let you use 100:1 leverage, that doesn’t mean you should use all of it. Using too much leverage increases your risk. Good traders manage this risk carefully.

Managing Risk: How Much Is Too Much?

Before entering a trade, you should always calculate how many pips you are willing to risk and how much capital you could lose. A common rule among traders is to risk no more than 3% of your total capital on a single trade.

Example:

- Trading account: $10,000

- You open 10 mini lots of USD/JPY

- Each pip move is worth $10

- A 30-pip stop-loss means a potential $300 loss

That $300 is 3% of your account. If you traded 100 mini lots instead, each pip would be worth $100, and a 30-pip loss would be $3,000—or 30% of your account. That’s too risky.

Why Leverage Is So Common in Forex

The forex market is one of the most liquid and active financial markets in the world. This liquidity allows brokers to offer high leverage like 100:1 or even more. Currency pairs usually move very little—less than 1% per day—so to make a decent profit, traders need to deal in large amounts. Leverage makes this possible.

Let’s say the GBP/USD pair moves 100 pips from 1.9500 to 1.9600. That’s only a 1 cent move. If you’re trading a large position like $100,000, that small move could mean a $1,000 profit or loss, depending on your trade direction.

Leverage in Action: A Comparison Example

Let’s look at two traders, both with $10,000 capital and trading USD/JPY.

- Trader A uses 50:1 real leverage to short $500,000.

- Trader B uses 5:1 real leverage to short $50,000.

Now imagine the price rises 100 pips. Here’s what happens:

| Trader | Real Leverage | Position Size | Pip Loss | Total Loss | % Capital Lost |

|---|---|---|---|---|---|

| Trader A | 50:1 | $500,000 | 100 pips | $4,150 | 41.5% |

| Trader B | 5:1 | $50,000 | 100 pips | $415 | 4.15% |

You can see how dangerous high leverage can be. Just one wrong trade cost Trader A nearly half their capital.

Forex vs. Stocks and Futures

Forex trading offers higher leverage than most other markets:

- Stocks: Typically limited to 2:1 leverage

- Futures: Often around 15:1

- Forex: Commonly 50:1 to 100:1 or more

Even though 100:1 sounds risky, it’s important to remember that currency prices generally move slowly. Still, improper use of high leverage can quickly lead to big losses.

Is Forex Volatile?

Forex markets are actually less volatile than many other markets, like real estate or stocks, mainly because they are so large and liquid. However, political or economic issues in a country—like defaulting on debt or trade problems—can suddenly increase volatility. So always stay aware of global events.

How Much Leverage Should You Use?

The best leverage level depends on your trading style, experience, and how much risk you can handle:

- New traders or those who want low risk: 5:1 or 10:1

- Experienced traders who manage risk well: 50:1 or even 100:1+

Never feel pressured to use the maximum leverage your broker offers. Instead, use only what makes you comfortable.

Final Thoughts: Handle Leverage with Care

Leverage can be a powerful tool when used wisely. It allows traders to earn good profits from small price changes in the market. But if used carelessly, it can wipe out your entire account in just a few bad trades.

Think of leverage like a sharp knife—it can help you prepare a great meal, or it can cut you badly if you’re not careful. The more you learn about managing leverage, using stop-loss orders, and setting reasonable risk levels, the safer and more profitable your forex trading journey will be.

Stick to your risk limits, trade with discipline, and remember: it’s not about how much you can make—it’s about how long you can stay in the game.

Join Gen Z New WhatsApp Channel To Stay Updated On time

https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30