In forex trading, understanding how powerful players like banks, hedge funds, and large financial institutions operate can give everyday traders a strong advantage. These major market participants—often called “smart money”—are known for driving significant price movements.

This guide breaks down the Smart Money Concept (SMC), explaining how the strategies used by institutional traders shape market action and how retail traders can use this insight to trade more effectively.

What Is the Smart Money Concept (SMC)?

At its core, the Smart Money Concept is based on the idea that retail traders can gain an edge by studying the behaviour of big players who move large amounts of money in the market. These include large banks, investment firms, and hedge funds—entities with deep pockets and in-depth knowledge of market conditions.

Unlike smaller retail traders, smart money participants often have access to cutting-edge tools, teams of analysts, and insider knowledge that allows them to make high-confidence trading decisions. Their trades can move the market, and their strategies usually reflect deeper trends and long-term outlooks.

Rather than simply copying what smart money does, the SMC approach encourages traders to understand how and where these big players are likely placing their trades.

This means paying attention to specific price zones, patterns, and imbalances that might reveal institutional activity. By aligning your trades with these areas, you can potentially position yourself on the same side as the market’s most influential players.

SMC shifts the focus from just technical indicators and price formations to also include the psychology and strategies of professional traders. This approach helps retail traders move from reactive to more strategic, proactive trading.

Key Ideas Behind the Smart Money Concept

SMC is built around several powerful trading ideas that give clues about institutional trading patterns and help traders recognize where and when smart money is likely involved.

Order Blocks

Order blocks are zones on the chart where large institutions have entered big buy or sell positions. These areas often form before a strong price movement and are considered signs of institutional interest. When the price revisits this zone, it often reacts by reversing direction, much like support or resistance.

Breaker Blocks

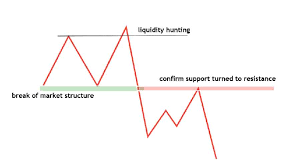

Breaker blocks are failed order blocks—areas where price breaks through an existing order block rather than bouncing off it. When this happens, the market may be signaling that the smart money has changed its direction. After this breakout, the order block may flip roles, becoming a resistance if it was a support or vice versa.

Break of Structure (BOS)

A BOS happens when the price breaks past a significant previous high or low, hinting at a potential shift in trend. It shows that a new market phase may be starting, often as a result of smart money making major moves. Recognizing a BOS helps traders spot early trend changes.

Change of Character (ChoCH)

This term describes a sharp shift in market behavior—such as a sudden price reversal or spike in volatility. ChoCH often follows a BOS and confirms that the market has likely changed direction. It reflects a possible switch in smart money sentiment and can signal new trading opportunities.

Fair Value Gaps (Imbalances)

These gaps occur when price moves rapidly and doesn’t leave much trading activity in between, creating an area of imbalance between buyers and sellers. Institutions often return to fill these gaps, so they become zones of interest for future price movement.

Liquidity Zones

Liquidity refers to areas on the chart where many pending buy or sell orders are likely placed, like stop-losses or breakout entries. These are commonly found near previous highs, lows, or round-number levels. Smart money may intentionally push price into these areas to trigger those orders and execute their own large trades, often resulting in bull or bear traps.

Accumulation and Distribution Phases

These phases describe when institutional traders are slowly building (accumulating) or unloading (distributing) their positions. Based on Wyckoff Theory, accumulation usually happens at lower prices before an uptrend, and distribution at higher prices before a downtrend. Recognizing these phases can help traders understand the likely next direction of the market.

How to Trade Using Smart Money Concepts

Trading with the Smart Money Concept takes more than just spotting zones on a chart. It requires interpreting how institutional investors think and behave. Below are the steps traders can follow to use SMC in real forex trading:

Step 1: Determine Market Trend (Using BOS and ChoCH)

First, figure out if the market is trending up or down. An uptrend forms when price creates higher highs and higher lows, while a downtrend shows lower lows and lower highs.

Watch for a Break of Structure to signal a trend change, and a Change of Character to confirm it. Together, they help define the overall market direction.

Step 2: Identify Order Blocks

Once a trend is identified, look for zones where the smart money likely entered—the order blocks. These often appear after a BOS or ChoCH. Look for strong price reactions away from these areas, especially if they also form fair value gaps or coincide with breaker blocks.

Liquidity around these areas—such as stop orders or consolidation zones—adds further confirmation that the zone is significant.

Step 3: Plan Your Entry

After finding a valid order block, decide how you’ll enter the trade. You might:

- Place a limit order at the edge of the order block

- Wait for a price confirmation—like candlestick patterns (e.g., hammer, engulfing, or shooting star)

- Use Fibonacci levels or indicators to fine-tune the entry

This step is about timing—entering the market only after you see signs of continuation in your expected direction.

SMC vs. Traditional Price Action

Although both the Smart Money Concept and price action strategies are widely used, they approach the market differently.

- Price Action focuses purely on reading price movement. Traders using this method look for patterns like double tops, pin bars, trendlines, and support/resistance zones. It’s clean, simple, and doesn’t rely on any external theories.

- Smart Money Concept, on the other hand, adds an extra layer of insight by focusing on what institutional traders are likely doing behind the scenes. It looks at where big orders are placed, where liquidity is gathered, and how market psychology influences price.

While price action helps you react to what’s happening right now, SMC helps you anticipate what might happen next based on deeper market structure.

Some traders stick to one method, but combining both can give you the best of both worlds—technical clarity from price action and strategic depth from SMC.

Final Thoughts: Why SMC Matters

The Smart Money Concept bridges the gap between retail traders and the large institutions that drive the forex market. By learning how to spot signs of institutional trading—like order blocks, BOS, and liquidity zones—you can become a more informed and strategic trader.

When you apply these principles, you’re no longer guessing where price might go. Instead, you’re making educated decisions based on how the “smart money” moves.

Platforms like FXOpen’s TickTrader offer tools to analyze live charts and apply SMC techniques in real time. Whether you’re a beginner or an advanced trader, understanding smart money behavior could be the key to staying ahead in the fast-paced forex market.

Join Gen Z New WhatsApp Channel To Stay Updated On time https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30