KCB Bank has continued to live up to its slogan “For People, For Better” by upgrading its mobile app to give Kenyans faster and easier access to all banking services — including instant loans.

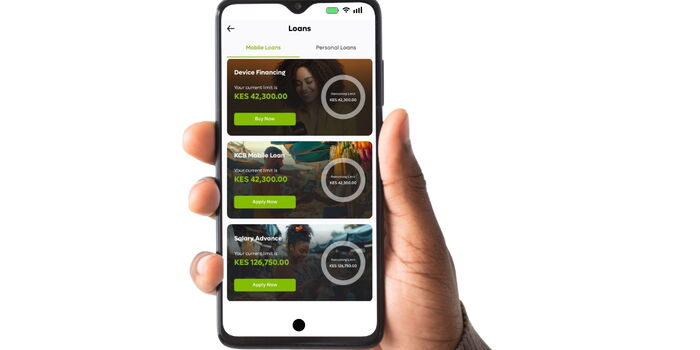

With the new and improved KCB Mobile App, customers can now explore, apply for, and manage different types of loans directly from their phones.

The app is designed around the daily financial needs of Kenyans, allowing users to handle everything — from opening an account and sending money to paying bills and tracking spending — all in one secure, user-friendly platform.

The new version of the app focuses on speed, convenience, and security, giving customers total control of their finances. Whether you want to cover an emergency expense, buy a car, or finance a personal goal, KCB’s loan services are now just a few taps away.

Through the app, users can instantly apply for loans of up to Ksh1 million and receive the money within minutes.

KCB offers flexible loan options with affordable interest rates that suit different financial needs. Some of the main loan products available include the KCB Flexi Loan, KCB Salary Advance, and a range of secured and unsecured loans.

KCB Flexi Loan: Easy, Fast, and Fully Digital

The KCB Flexi Loan is one of the most convenient mobile loan options in Kenya. It gives customers full control, allowing them to borrow small or large amounts as needed — anytime, anywhere.

For example, you can borrow Ksh5,000 on Monday, Ksh3,000 on Wednesday, and Ksh2,000 on Saturday, and all requests will be approved instantly as long as you remain within your set loan limit.

Customers can borrow from as little as Ksh1,000 up to Ksh1 million, depending on their eligibility and account history.

One of the key features of the Flexi Loan is its custom repayment period, which ranges from 1 day to 12 months. The shorter your repayment period, the lower the interest charged. For instance, a 1–7 day repayment period comes with lower interest compared to a 3-month plan.

Requirements:

- Must have operated a KCB account for at least 6 months.

- Must have the KCB Mobile App installed.

- Must have a good credit history.

Benefits:

- Instant approval and disbursement.

- Flexible repayment terms.

- Fully digital process.

- Interest rates as low as 1.2%.

KCB Salary Advance: Quick Cash Before Payday

The KCB Salary Advance is perfect for salaried individuals who need a quick boost before the end of the month.

This short-term loan helps cover emergencies or personal expenses, with minimal paperwork and near-instant disbursement directly to your phone. You can access up to Ksh500,000, which is equivalent to 1.5 times your monthly salary, repayable within six months.

Requirements:

- Must be a salaried KCB account holder.

- Account must have been active for at least three months.

Benefits:

- Instant cash disbursement.

- Easy to apply directly from the KCB Mobile App.

- Minimal documentation required.

- Short repayment period for quick financial relief.

KCB Unsecured Loans: No Collateral Needed

KCB’s unsecured loans provide quick access to funds without the need for collateral, making them one of the most popular financing options in Kenya. These loans are granted based on your creditworthiness, income, and overall financial stability.

The bank offers several unsecured loan types, including:

- Salary Advance

- Masomo Loan

- Personal Unsecured Check-Off Loan

- Personal Unsecured Non-Check-Off Loan

Personal Unsecured Non-Check-Off Loan

This loan offers up to Ksh4 million with no collateral and a repayment period of up to 48 months. It is available to both salaried and self-employed customers who have maintained an active KCB account for at least three months.

Benefits:

- No security required.

- Flexible repayment terms.

- Can borrow as little as Ksh20,000.

Personal Unsecured Check-Off Loan

This loan is designed for government employees and workers in organizations that have partnerships with KCB. It allows borrowers to access up to Ksh10 million, repayable in up to 10 years through salary deductions made by the employer.

Requirements:

- National ID or valid passport.

- KRA PIN.

- Duly filled application form.

- Three most recent payslips (original).

Benefits:

- Long repayment period.

- No collateral required beyond employer guarantee.

- Convenient monthly repayment through salary deductions.

Masomo Loan (Education Loan)

The Masomo Loan supports students or guardians who want to fund education either locally or abroad. You can borrow between Ksh100,000 and Ksh4 million, depending on your credit score and need. The loan covers tuition fees and other education-related expenses, and it comes with a repayment period of up to 24 months.

Requirements:

- Active KCB account (minimum of three months).

- Valid ID or passport.

- Latest payslips or proof of income (for self-employed).

- Admission letter from the learning institution.

Benefits:

- Fast loan processing.

- Flexible repayment schedules.

- Helps learners focus on studies without financial stress.

KCB Secured Loans: Backed by Collateral

Secured loans are supported by collateral such as land, vehicles, or other valuable assets. These loans offer higher amounts and longer repayment periods.

Personal Secured Loan

This facility allows customers to borrow based on the value of their collateral. For example, if your car is worth Ksh2.5 million, that becomes your maximum loan limit.

It is available for both salaried and self-employed individuals and offers a repayment period of up to 10 years.

Requirements:

- Valid ID or passport.

- KRA PIN.

- Application form.

- Proof of asset ownership (title deed, logbook, etc.).

Benefits:

- Long repayment period.

- Competitive interest rates.

- Access to higher loan amounts.

Personal Car Loan

Under this category, KCB offers flexible car financing options, including 100% or partial financing, depending on the car’s purpose and value.

For example:

- School buses: 100% financing, repayable over 72 months.

- Toyota Hiace (14-seater matatu): 100% financing, repayable over 36 months.

- Personal cars (e.g., VW Touareg): Up to 95% financing, with 60 months repayment period.

Requirements:

- Available for both salaried and self-employed customers.

Benefits:

- Flexible repayment options.

- Financing tailored to different car types and uses.

- Competitive interest rates.

Get Started Today

The new KCB Mobile App is available for download on Google Play and the App Store. You can even open a new KCB account directly from the app in just a few minutes — no need to visit a branch.

With KCB’s upgraded app, Kenyans now have the power to manage their money, apply for loans, and achieve their financial goals — all from the palm of their hands.

Join Government Official WhatsApp Channel To Stay Updated On time

https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30