Decentralized Finance (DeFi) has been reshaping the financial world, offering people ways to lend, borrow, and invest without relying on banks.

While DeFi has seen rapid growth, one of its challenges has been linking real-world assets to blockchain-based lending. This is where RWA-backed crypto loans are making a big difference.

What Are RWA-Backed Crypto Loans?

RWA stands for Real-World Assets. In simple terms, these are tangible or financial assets from the traditional economy, such as real estate, company bonds, or even invoices.

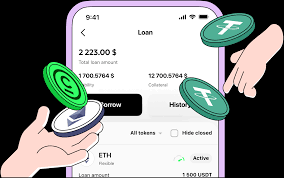

RWA-backed crypto loans are loans issued on blockchain platforms where these real-world assets are used as collateral.

Instead of relying only on volatile cryptocurrencies like Bitcoin or Ethereum, DeFi platforms can now offer loans backed by something more stable and predictable. This helps reduce the risk of default and opens the door for larger, more secure loans.

Why RWA Loans Matter in DeFi

- Reduced Volatility – Cryptocurrencies are known for rapid price swings. By using real-world assets as collateral, DeFi loans become less vulnerable to sudden market crashes.

- Access to Institutional Investors – Traditional investors like banks, hedge funds, and insurance companies are more likely to participate when real-world assets are involved. This brings more liquidity to DeFi platforms.

- Bridging Traditional Finance and DeFi – RWA loans create a direct connection between the traditional financial world and blockchain. Real-world collateral gives DeFi a level of credibility and stability that pure crypto-backed loans often lack.

- Diversification Opportunities – Borrowers and lenders can use a mix of crypto and real-world assets, spreading risk and potentially earning better returns.

How RWA-Backed Loans Work

The process typically follows these steps:

- Asset Tokenization – Real-world assets are represented as digital tokens on the blockchain. For example, a property worth $1 million could be represented as a token worth the same value.

- Collateralization – These tokens are deposited on a DeFi platform as collateral for a loan.

- Loan Issuance – Borrowers receive crypto loans proportional to the value of their RWA tokens.

- Repayment and Unlocking – Once the borrower repays the loan with interest, the collateral tokens are returned. If the borrower defaults, the lender can claim the underlying asset.

Examples of Platforms Using RWA Loans

Several DeFi platforms have started integrating RWA-backed loans:

- Centrifuge – Focuses on tokenizing invoices and business assets to fund DeFi loans.

- Maple Finance – Offers institutional-grade loans using real-world collateral.

- MakerDAO – Has begun experimenting with tokenized real-world assets as additional collateral types.

These platforms show how RWA loans are gradually becoming a mainstream part of DeFi, attracting both retail and institutional users.

Challenges and Risks

While RWA-backed loans are promising, they come with challenges:

- Regulatory Uncertainty – Real-world assets are subject to local laws, which can complicate DeFi operations.

- Valuation Issues – Determining the accurate value of an asset on-chain can be tricky.

- Liquidity Concerns – Real-world assets may not be as easily liquidated as crypto, which could delay repayments in case of defaults.

The Future of RWA-Backed DeFi

Despite the challenges, RWA-backed loans are likely to grow in importance. By providing stability, credibility, and wider access to institutional investors, they are helping DeFi move beyond a niche market into a more mainstream financial ecosystem.

Experts predict that as technology improves and regulations become clearer, the integration of real-world assets into DeFi could redefine borrowing and lending on blockchain, bridging the gap between traditional finance and decentralized systems.

Join Government Official WhatsApp Channel To Stay Updated On time

https://whatsapp.com/channel/0029VaWT5gSGufImU8R0DO30